Tax Relief on Electric Cars: What Are the Tax Benefits of Driving an Electric Car?

One of the advantages of leasing with salary sacrifice is how much more affordable it is to have an electric car.

- You benefit from a very low BiK.

- You benefit from an exemption on your VAT.

- You can save up to 60% every month when you are registered with Loveelectric.

And that's not all!

In this article, we'll give you an overview of all the ways you can save tax with an electric car.

Note: are you an employer or employee interested in implementing an electric car scheme for your company? With Loveelectric, employers can offer the electric car salary sacrifice scheme as an employee benefit at no extra cost. Get set up now.

Road tax

The official name for road tax is Vehicle Excise Duty (VED), however, it’s also often referred to as road tax. VED is something drivers have to pay for each year, and the money goes towards road work and maintenance.

On average, the amount of VED paid in the UK is £155 per vehicle every tax year, however, this is expected to increase in April of 2022 at the start of the next financial year due to inflation. The amount of road tax you pay is dependent on a couple of factors, like whether you have a high or low-emission vehicle, how much CO2 your vehicle emits and how old it is. We recommend checking out this resource from HMRC to learn more.

Do electric cars pay road tax?

Electric Vehicles - whether used for private use or as a company car - are currently exempt from road tax. So if you drive an EV you won’t need to pay a single penny in road tax. However, this is changing from 1st April 2025 onwards. Any EVs registered between 1 April 2017 and 31 March 2025 will be required to pay the standard road tax rate of £180/year. Any vehicle registered after 1 April 2025 will only have to pay £10 for the first year, before moving to the standard road tax rate onwards.

Salary sacrifice

A great way to save even more with an electric car is by using a salary sacrifice scheme, you could save up to 60% of the full cost of your EV if you’re signed up to Loveelectric, as there are so many potential tax savings (all HMRC approved!).

What is salary sacrifice?

So, what is salary sacrifice and how does it work? Salary sacrifice is a scheme where an employee gives up a portion of their salary and in return, they receive a benefit. You might have heard about salary sacrifice in the context of pensions, childcare vouchers, and the cycle-to-work scheme; however, you can also use it to get an electric car for a more affordable price. All that’s needed is for your employer to sign up for free here.

Do you pay tax on salary sacrifice cars?

As a great taxpayer, it makes sense to be curious about the tax implications of using an EV.

So, the short answer to the above question is yes, signing up for a salary sacrifice scheme will still mean you pay tax. However, the amount you will have to pay is significantly smaller than if you purchase the car or lease it using a PCH or BHC lease (read more about the differences here).

If you sign up with the Loveelectric salary sacrifice scheme, you’ll end up saving more than you would when using standard leasing options due to our triple tax savings.

Triple Tax Saving

- VAT

VAT is the acronym for Value Added Tax, and it’s something you pay for all consumer goods and services. By using a salary sacrifice to lease an electric car, your incentive is you won’t need to pay VAT, and this tax is passed onto your employer, who can reclaim back 10% of the VAT cost from the government.

- Income Tax

Just like the name suggests, income tax is a tax on your income and the amount you pay is based on how much you earn. Depending on how much you make per month, you could be placed in a couple of different tax brackets. (Read more about this on the HMRC website) The higher income you have, the more tax you have to pay, so by forgoing a small portion of your salary and in return for getting a new electric car, you’ll pay less in income tax.

- NIC

Like income tax, your National Insurance Contributions (NIC) is based on how much you earn. NIC is used to pay for benefits like healthcare, social care, and pensions. If you’re signed up to the loveelectric salary sacrifice scheme, you’d forgo a portion of your salary every month in exchange for having the electric car, which would result in a lower salary to pay National Insurance contributions for.

Employers NIC

It’s not just employees that can save money with a salary sacrifice scheme! As employers also have to pay NI, having their employers earn slightly less in return for the electric car will mean they too save money.

Benefit In Kind tax electric cars

Benefit in Kind (BIK) is a term you may have come across before, essentially it's a taxable benefit that you receive related to your employment. This benefit does not have to be limited to being something you only use within business hours.

If you have a car through your employer then no matter what kind of car it is, you have to pay BIK tax to HMRC. The amount of BIK tax you have to pay is calculated by taking a percentage of the P11D value (which is the list price of the car), this percentage will be based on the levels of CO2 emissions from the car and the more CO2 it emits, the higher the tax will be. As EVs don’t emit any CO2 the BIK rate is very low, sitting at only 1% until the next financial year, where it will increase to 2% and remain at that rate until 2025.

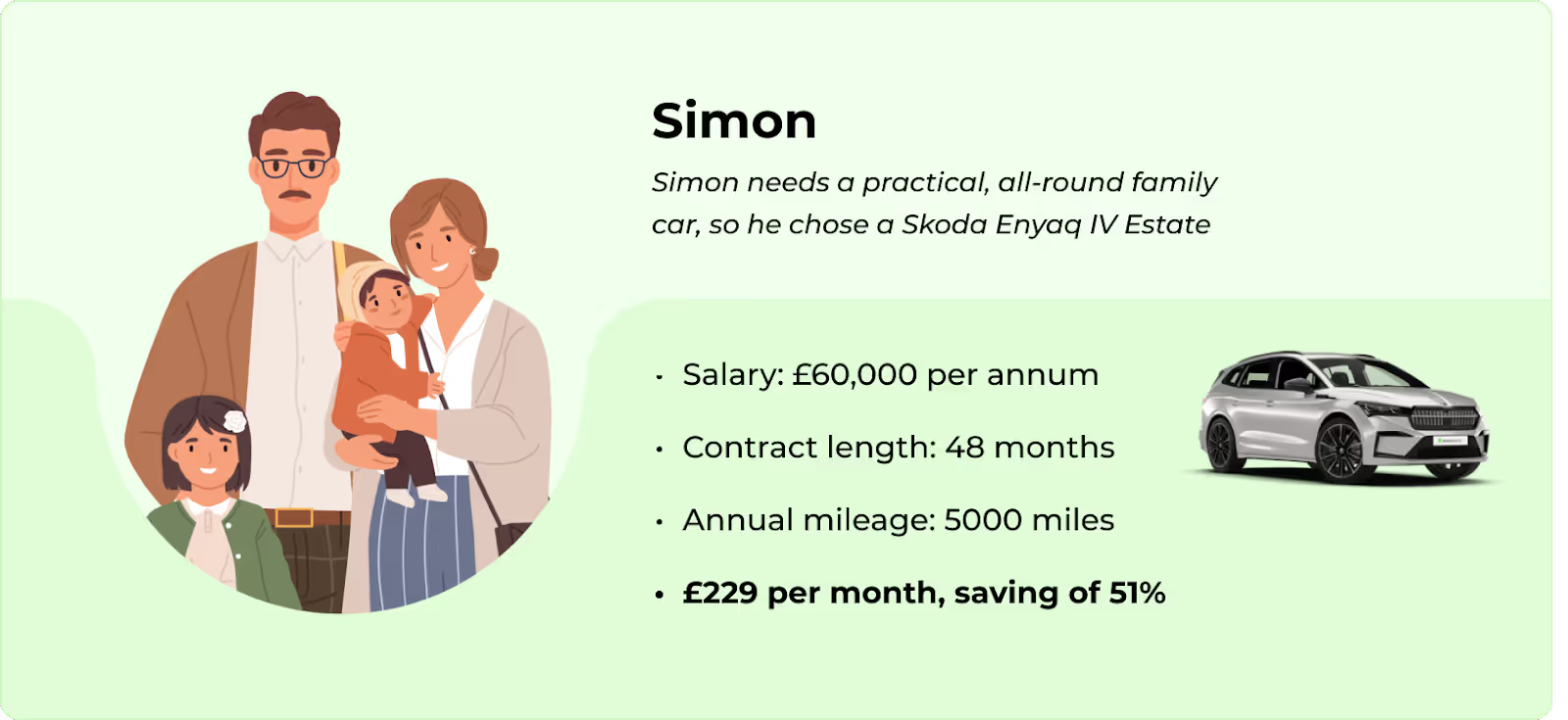

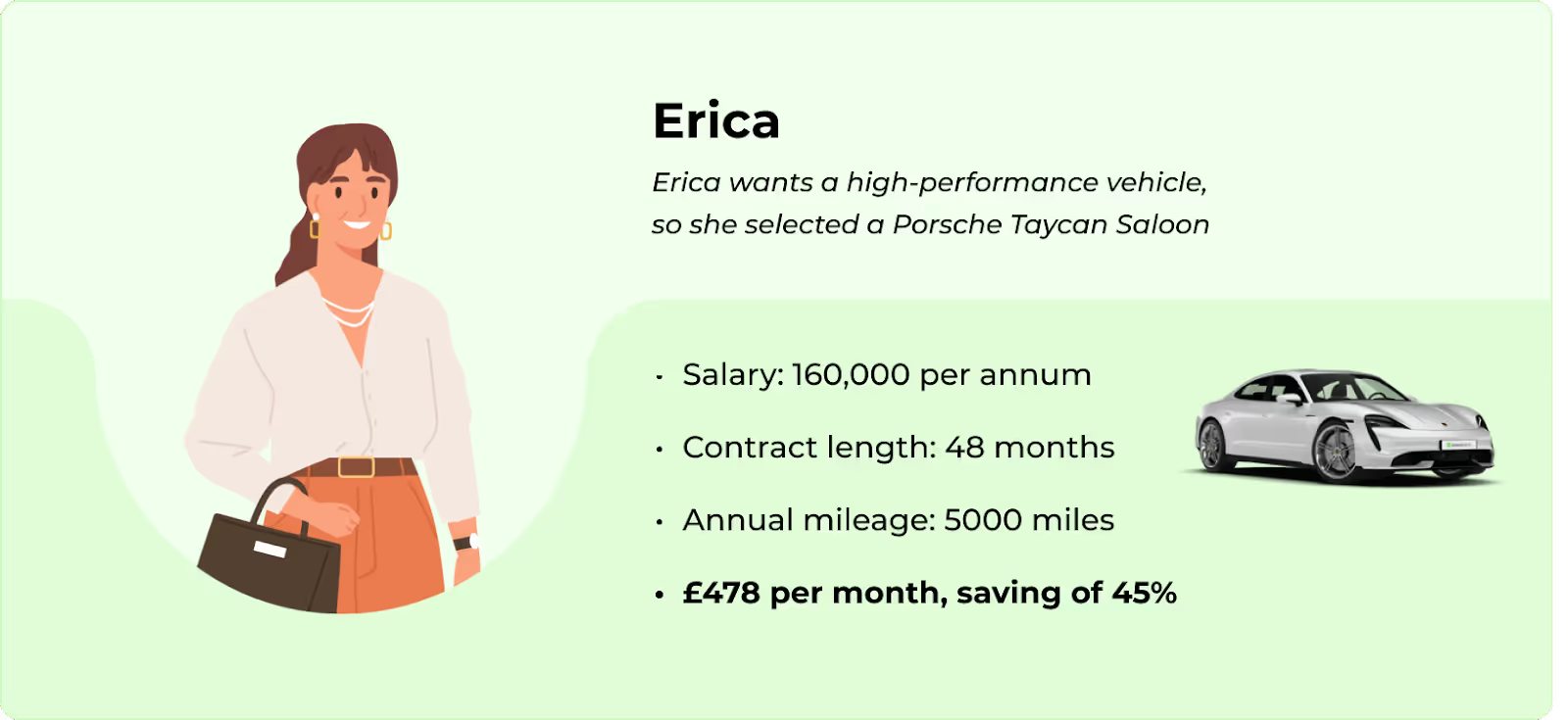

How much could I save?

Here are some examples of how much you could save on a brand new electric car every month when you’re signed up to the loveelectric salary sacrifice scheme.

This doesn't take into account the number of government grants that you might also be able to access. For example, if you live in Scotland you might be able to get £250 off the installation of a home charging point. Read more about the various grants you can get here: What Government Grants can you get for your electric car?

Find out how much you could save with our Salary Sacrifice Calculator.

Electric Car Tax Benefits — Frequently Asked Questions

The government recently put a ban on the sale or lease of new petrol and diesel cars and vans to 2030. Consequently, there are many benefits that come with driving an EV, but these are not always obvious.

Here are some questions that constantly pop up when it comes to the tax advantages of EVs.

How long will electric cars be tax-free?

The government is currently on a mission to convince car buyers to opt for zero-emission vehicles, with zero road tax rates. So, you don't have to pay money to get road tax (VED) on a fully electric car in 2022-2023.

Can you claim 100% on electric cars?

As a company, you can claim 100% capital allowances on cars you buy and use in your business. This means you can deduct part of the value from your profits before you pay tax. Moreover, there are no restrictions on the value of the vehicle.

Any business can benefit from the new super deduction, which offers a first-year allowance of up to 130 percent on qualifying electric charge points for cars. To claim the relief, your business must use the charging point as part of its own trading. The tax relief will be effective until 31 March 2023.

How much VAT can you claim back on an electric car?

VAT is charged on electric cars and their charging in the same way as on combustion cars and fuel costs. However, businesses can claim back the VAT on the purchase of an electric car and the charging.